The government has 3 basic functions, allocation, distribution, and stabilization about which we have discussed in our recent article Revenue Sources of Indian Government.

In this article, we are going to discuss various areas of Expenditure of the Indian government. The contents of the article are as follows

- Types of Classification of Government

- Centre Expenditure

- Transfers

- Revenue Expenditure

- Capital Expediture

Types of Classification of Government Expenditures

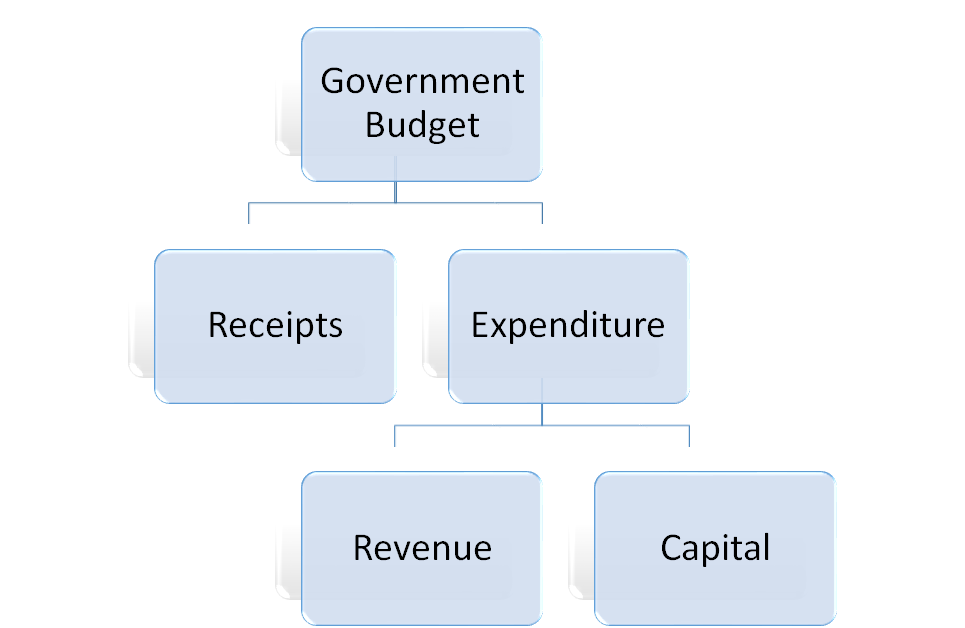

First of all, Let’s take a look at the classification of the government budget’s expenditure.

The Government expenditure can be classified in 2 ways. one is in the form of type of usage and the other in the form of the nature of Expenditure.

Let’s talk about these types one by one.

Centre’s Expenditure

The Centre’s expenditures are those expenditures that are done by the central government itself.

These includes

- Establishment expenditure

- Central sector schemes

- Salary and pensions

- Interest payments

- Subsidies

- Defence

Establishment expenditure: These are all the administrative expenses of the government which include office Expenses, foreign travel Expenses, domestic travel expenses, material and supplies expenses, etc.

Central sector schemes: These include all the Central government schemes which are 100% funded by the government like Bharatnet, Namami Gange-National Ganga Plan, LPG connection to poor households, Crop Insurance Scheme, and Pardhan Mantri mudra yojana, etc.

Salary and Pensions: These include all the expenses done by the government on salary and pensions of military, police, railways, and other government departments.

Interest payments: These include all the Interest to be paid by the government for the loans that the government had taken from various banks and foreign institutions.

Subsidies: The money spent on all the subsidies run by the government like subsidy on LPG, subsidy on Education, etc.

Defense: The money spends on Military equipment like arms, ammunition, tanks, fighter planes, etc.

Transfers

Transfers refer to the money given by the Central government to the state government.

These includes

- Centrally sponsored schemes

- Finance commission grants

- Other grants

Centrally sponsored schemes: These are those schemes that are sponsored by the central government and implemented by the state government. i.e. the money spent in the scheme is shared between the central government and state government in the ratio of like 50:50, 70:30, 77:25, 90:10, etc. In which the larger portion is always paid by the central government. A few such schemes are Pardhan Mantri Awaas Yojana, Midday Meals in schools, and Swach Bharat Abhiyan, etc.

Finance commission grants: the money which is given by the central government to the state government to manage their expenses. This money is the share percentage of the Tax collected by the government, which is different for every state, and recommended by a Finance Commission every 5 years.

Other Grants: the money given by the central government to the state government in Natural Calamities like Flood, Earthquakes, Cyclones, etc to recover from the heavy loss in those emergency situations.

Revenue Expenditure

Revenue Expenditures are those Expenditures Which Neither create an asset for the government nor reduce any liability on the government.

Capital Expenditure

Capital Expenditures are those Expenditures Which Either create some asset for the government or reduce any liability on the government.

Now let’s take a look at the Expenditures we talked about earlier in the article, and figure out which type of expenditure are they, whether they come under Revenue or Capital Expenditure.

Establishment expenditures are of both types but, it mostly comes under Revenue Expenditure, as these expenses hardly create an asset for the government or reduce any liability on the government.

Central Sector Schemes – Various types of schemes are run under various ministries of the government like in the health sector, education, and transport sector. So when this money is used to create an asset like in

Health sector- to build hospitals

Education sector – to build schools & colleges,

Transport sector- to build National Highways, expressways, etc or to purchase public transport in Roadways or Railways.

then these expenses come under Capital Expenditure.

And the money which is spent on the maintenance of these hospitals, schools, roads, and public transports comes under the category of revenue Expenditure.

Salary and Pensions – these expenses also come under revenue expenditure.

Interest payments – these expenses reduce the liability on the government, therefore come under capital Expenditure.

Subsidies – Government has to spend a lot of money on subsidies, which doesn’t create an asset for the government, that is why the government always tries to minimize their expense on subsidies because it comes under the revenue expenditure of the government.

Defense – All the weapons, gadgets, fighter planes(like Rafale which is recently purchased by the government), etc are very very important for the safety and security of the country. So purchasing of these would come under capital Expenditure and the money spent on their maintenance would come under revenue expenditure.

Centrally sponsored schemes – the money which is used to create new infrastructure like new Power plants, new water supply infrastructure, etc would come under capital expenditure, and the money which is spent on the maintenance of this infrastructure or for any other purpose would come under revenue expenditure.

You may refer to this video if you want the explanation in Hindi