Any profits or gains arising from the transfer of capital assets effected in the previous year is called Capital Gain and Tax chargeable on this capital gain is called capital gain Tax.

Capital Assets

Capital Assets means

- Property of any kind held by the assessee, whether or not connected with business or profession.

- Any securities held by a foreign institutional investor (FII)

but capital asset does not include:

- Stock-in-trade (RM, WIP, FG)

- Movable personal property (used by assessee or his dependent family member for the personal purpose for example:- T.V, Car, Mobile etc), but Excludes: Jewellery, Drawings, Painting, Sculpture, Archeological Collection or any other work of art

- Gold Deposit Bonds, 1999 or Deposit Certificates issued under the Gold Monetisation Scheme, 2015

- Rural Agriculture Land

Definition of Rural Area– Any area which is outside the jurisdiction of municipality or cantonment board, having a population of 10000 or more is considered a Rural Area and it should not fall within a distance given below

| Distance | Population |

| 2 km from the local limit of municipality or cantonment board | >10000 up to 100000 |

| 6 km from the local limit of municipality or cantonment board | >100000 up to 1000000 |

| 8 km from the local limit of municipality or cantonment board | >1000000 |

Definition of Transfer:

Transfer includes:

- The sale, exchange or relinquishment of the assets, or

- The extinguishment of any right therein, or

- Compulsory acquisition thereof under any law, or

- Conversion of capital asset into stock in trade, or

- Allowing the possession of any immovable property to be taken or retained in part performance of a contract.

- Any transaction (like becoming a member of, or acquiring shares in a co. operative society) which has the effect of transferring or enabling the enjoyment of immovable property.

- The redemption of Zero Coupon Bonds (ZCB)

Type of Capital Assets:

Short Term Capital Assets

The assets which are held for less than 36 months are considered short-term capital assets, which is 24 months in the case of unlisted shares and 12 months in the case of Listed securities, Equity oriented Mutual Fund and Zero-coupon bonds.

Long Term Capital Assets

The assets which are held for more than 36 months are considered as long-term capital assets, which is 24 months in the case of unlisted shares and 12 months in the case of Listed securities, Equity oriented Mutual Fund and Zero-coupon bonds.

Calculation of Capital Gain

Full value of consideration XXX

Less:- Expenses incurred in connection of transfer XXX

Net Consideration XXX

Less:- Cost of Acquisition (COA) XXX

Less:- Cost of Improvement (COI) XXX

Capital Gain XXX

Few terms you need to know while calculation capital gain

Full value of consideration:- The consideration received or to be received by the seller as a result of the transfer of capital asset.

Cost of Acquisition:- The value for which capital asset was acquired by the seller.

Here, COA will be Actual Cost or FMV as on 01/04/2001, whichever is higher.

Improvement done before 01/04/2011 should be ignored.

Cost of Improvement:- Expenses of capital nature incurred in making any additions or alterations to the capital asset by the seller

In the case of Long-term capital assets, COA & COI should be Indexed.

Indexed Cost of Acquisition:-

Indexed Cost of Improvement:-

CII table

| Financial Year | Cost Inflation Index (CII) |

| 2001-02 (Base year) | 100 |

| 2002-03 | 105 |

| 2003-04 | 109 |

| 2004-05 | 113 |

| 2005-06 | 117 |

| 2006-07 | 122 |

| 2007-08 | 129 |

| 2008-09 | 137 |

| 2009-10 | 148 |

| 2010-11 | 167 |

| 2011-12 | 184 |

| 2012-13 | 200 |

| 2013-14 | 220 |

| 2014-15 | 240 |

| 2015-16 | 254 |

| 2016-17 | 264 |

| 2017-18 | 272 |

| 2018-19 | 280 |

| 2019-20 | 289 |

| 2020-21 | 301 |

| 2021-22 | 317 |

Cost of Acquisition and Improvement in case of Intangible assets:-

In case of

- Goodwill of Business not Profession,

- Trademark,

- Brand name,

- Right to manufacture, produce, process any article or things (patent & copyright),

- Right to carry on any business or profession,

- Tenancy right,

- Loom hours,

- Route permits

If the asset is self-generation then COA shall be NIL, If the asset is purchased then COA shall be Purchase Price.

Note 1: Benefits of FMV as of 01/04/2001 NOT available in case of Intangible assets.

Note 2: No capital gain on the goodwill of the profession.

Tax Rate on Capital Gains

| Long term Capital Gain | except Equity shares or Equity oriented units or Units of business trust | 20% |

| Long term Capital Gain | Equity shares or Equity oriented units or Units of business trust | 10% over and above Rs. 100000 (subject to certain conditions) |

| Short term Capital Gain | except Equity shares or Equity oriented units or Units of business trust | As per the slab rate |

| Short term Capital Gain | Equity shares or Equity oriented units or Units of business trust | 15% ( (subject to certain conditions) |

Certain conditions are:

In case of Long Term Capital Gain-

STT paid on acquisition & transfer of equity shares

STT paid on transfer of equity-oriented units & units of business trust.

In case of Short Term Capital Gain-

STT paid on the transfer of assets

Example:- Ritika bought a house in Aug 2007 for Rs. 45 Lakh and ritika sold this house in F.Y 2019-20 for Rs. 1.5 crore. Since the property was held for over 3 years, this would be a Long term Capital asset. The cost price will be adjusted for inflation and indexed cost of acquisition will be taken.

Adjusted cost of the house after Indexation is 1crore. The net capital gain is 50 lakhs. Long-term capital gain is taxable @ 20% and the total tax outgo will be 10.23 lakhs.

Sec 54: Exemption on sale of House Property on Purchase of another House Property

As per sec 54, the long-term capital gain arising to an individual or HUF from the sale of house property shall be exempt by investing the sale consideration in buying the other two house properties.

The exemption on two house properties will be allowed once in the lifetime of a taxpayer, provided the capital gains do not exceed Rs. 2 crores.

The taxpayer has to invest the amount of capital gains and not the entire sale proceeds. If the purchase price of the new property is higher than the amount of capital gains, the exemption shall be limited to the total capital gain on sale.

Conditions to avail the benefits are:-

New property should purchase within a period of 1 year before or 2 years after the date of transfer or construct another house within a period of 3 years from the date of transfer.

The new property should not be transferred within 3 years from the date of purchase/completion of construction otherwise capital gain shall be reduced from the value of cost of acquisition.

Sec 54F: Exemption on capital gain on sale of any asset other than house property

As per sec 54F, the long-term capital gain arising to an individual or HUF from the sale of any asset other than house property shall be exempt by investing the entire sale consideration not only capital gain in buying the new house property.

To avail this exemption seller needs to invest the entire amount in buying the house property 1 year before of 2 years after the date of transfer or construct the house property within 3 years from date of transfer.

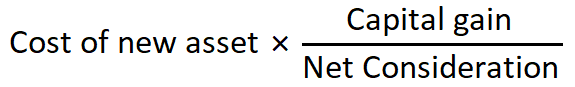

If the seller invests only the portion of sale consideration, the capital gain exemption will be in the proportion of the invested amount to the sale price =

If the new house is transferred within 3 years from the date of purchase, then the exempted capital gain will be taxable in the year of transfer and it will be considered as Long term capital gain.

Sec 54EC: Exemption by reinvesting the LTCG in certain bonds

Exemption u/s 54EC is available when long-term capital gain arises from the sale of Land, Building or both is invested in the specific bonds, which are National Highway Authority of India or Rural Electrification Corp. Ltd. or Power Finance Corp. Ltd. Or Indian Railway Finance Corp. Ltd.

The maximum exemption limit under this section is 50 lakhs. If the money invested in these bonds is transferred or redeemed before 5 years then exempted long term capital gain will be taxable in the year of transfer.

Sec 54B: Exemption on Capital gain on sale of urban agricultural land & used for another agricultural Land

When capital gain arises from sale of urban agriculture land invested in buying rural agriculture land by individual or HUF shall be exempt from tax.

Conditions to avail the benefits are:

Agriculture land should be used by individual or individual’s parents or HUF for agriculture purpose at least for a period of 2 years immediately preceding the date of transfer.

Capital gain from the sale of urban agricultural land should be reinvested into rural agricultural land within 2 years of transfer. If individual or HUF is not able to buy the Land before filling of return then the amount can be invested into Capital Gain Account Scheme and it will be taxable in the year when 2 years have been completed from the date of transfer if not used for the purchase of rural agriculture land.

Dear sir

I want to read political science in PDF

So kindly provide me PDF🙏🙏🇳🇪

Dear sir

I want to read political science in PDF

So kindly provide me PDF 🙏🙏