What is NPS ?

When we simply talk about what is Pension? its means when a person comes to a specific age which generally considered 60, Government provide some monthly amount to the person so that he/she can fulfill their basic needs in case they are not able to work or get job at that age.

National Pension Scheme is this social security which is initiated by government of India, this pension scheme is available for employees belongs to every sector be it Private, Public or Unorganized sector apart from them any Indian citizen can also apply for this pension scheme.

In this scheme people have to invest on their pension account regularly from the income they earn from their job. That amount is collected and returned to them at their retirement in the form of monthly pension.

In case anyone changes their job then in the next job also they can use the same pension account.

Who should invest in NPS ?

NPS is a very good scheme for those people who want to plan for their retirement from an early stage, Or people with low risk capacity.

Those people who work in private sector they can invest a nominal amount, which starts from just Rs 500 from their monthly salary in NPS regularly and when they will retire they will get fixed amount of every month in the form of pension which they only invested in NPS.

In this scheme they get more amount what they have put into their NPS account because that amount is invested from which they get approximately 10% per annum compounding income.

Benefits of NPS ?

- Regulated – NPS is regulated by PFDRA(Pension fund regulator under government of India) so it is very much secure.

- Transparency – NPS account can be accessed online which tells you that your investments are added and what is the total amount of your investment.

- Long Term Returns – NPS is a long term investment plan, NPS have a minimum lock in period of 10 years, from which the subscriber gets compounding benefit, which means that whatever interest he received till now from the deposited money it is reinvested, and doing that again and again increases the benefits.

How To Open NPS Account ?

There are two ways to open a NPS account

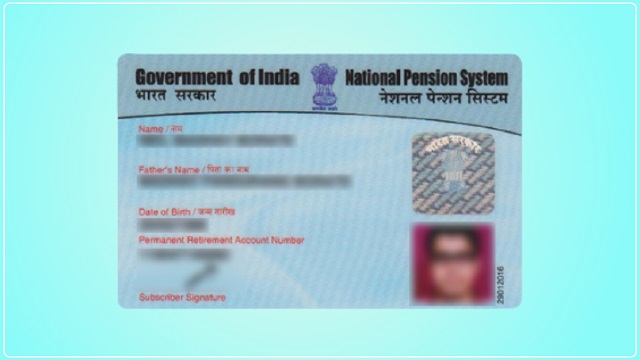

- Offline – To open an NPS account manually, first you need to find a POP means Point of presence, some banks do these works so you can contact your bank. In case of bank you don’t have to do the KYC also because your Bank already have your KYC. So after completing all the formalities as you make your first investment which can be started from just Rs 500 per month after that bank will send you PRAN ( Permanent Retirement Account Number) and your password which you need to keep safely so that you can access your NPS account online whenever you want.

2. Online – In online process you can open your account in 30 minutes,

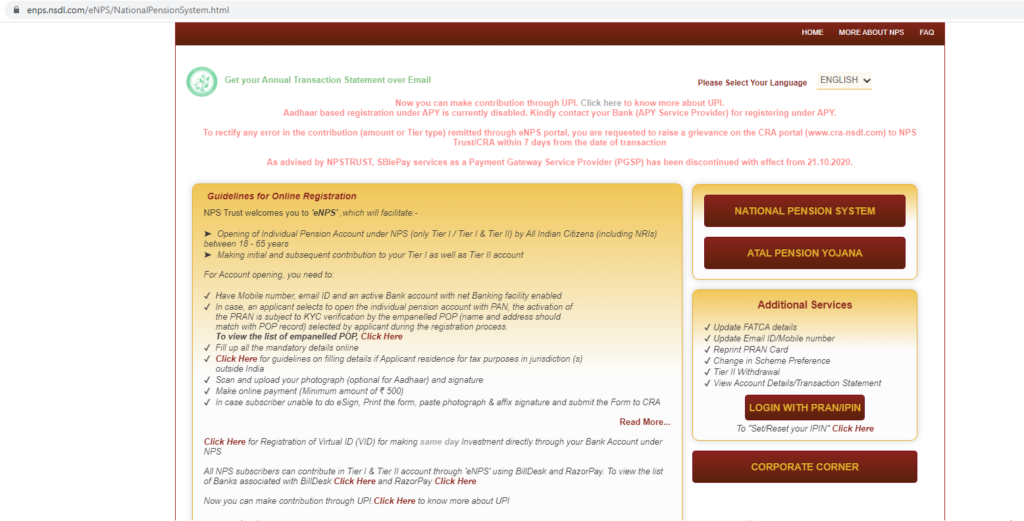

You need to visit this website enps.nsdl.com, and then click on the national pension scheme

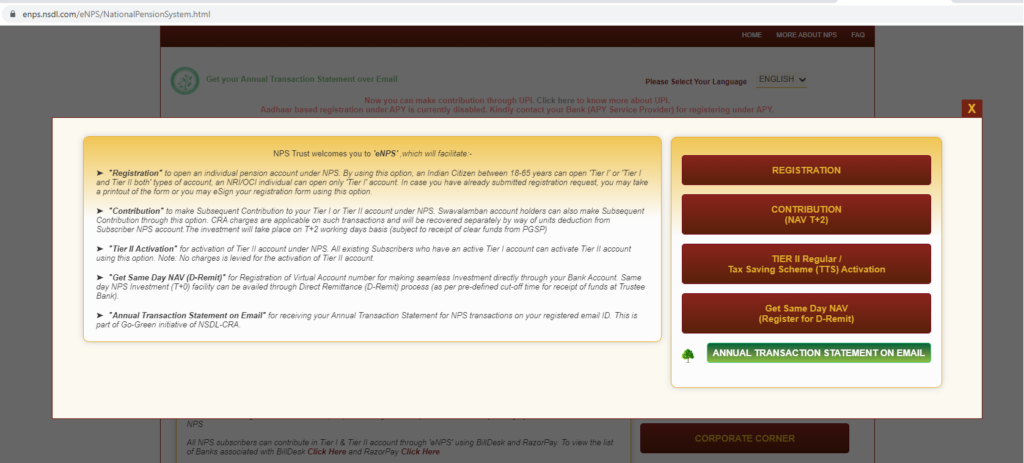

Click on registration

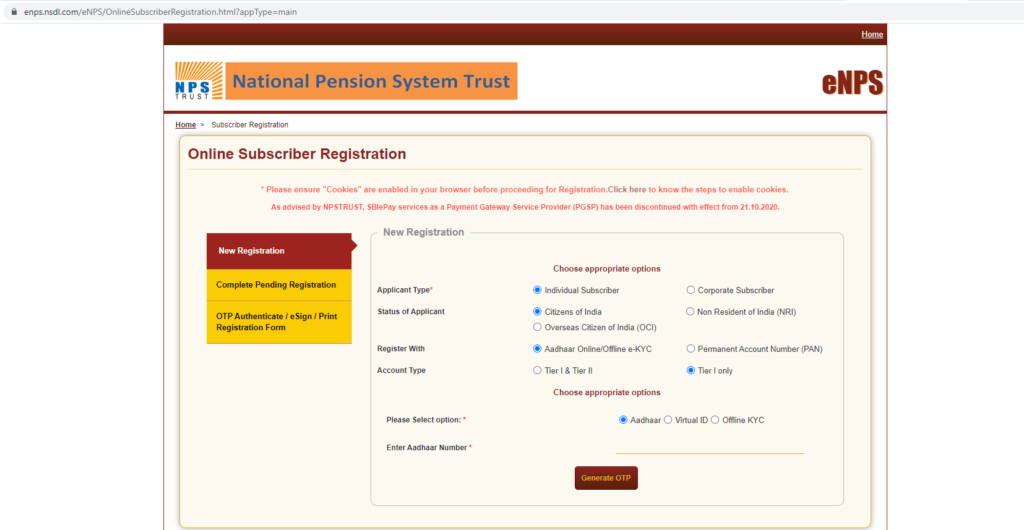

Put all your details and your permanent account number will be generated, like this you can easily open you NPS account online.

You may refer to this video if you want the explanation in Hindi